Paid Cash For Supplies Account Title . Journal entries | financial accounting. There is a date of april 1, 2018, the debit account titles are listed first with cash and supplies, the credit account title of common stock is. For example, a company that just purchased its office supplies from company b and received an invoice of $500 should record the amount in its. The normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. The company can make the journal entry for the supplies it paid the cash for by debiting the office supplies. A paid cash on account journal entry is needed when a business has paid cash to a supplier and the amount is not allocated to a particular. Paid cash for supplies journal entry.

from slideplayer.com

A paid cash on account journal entry is needed when a business has paid cash to a supplier and the amount is not allocated to a particular. For example, a company that just purchased its office supplies from company b and received an invoice of $500 should record the amount in its. The normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. Journal entries | financial accounting. The company can make the journal entry for the supplies it paid the cash for by debiting the office supplies. Paid cash for supplies journal entry. There is a date of april 1, 2018, the debit account titles are listed first with cash and supplies, the credit account title of common stock is.

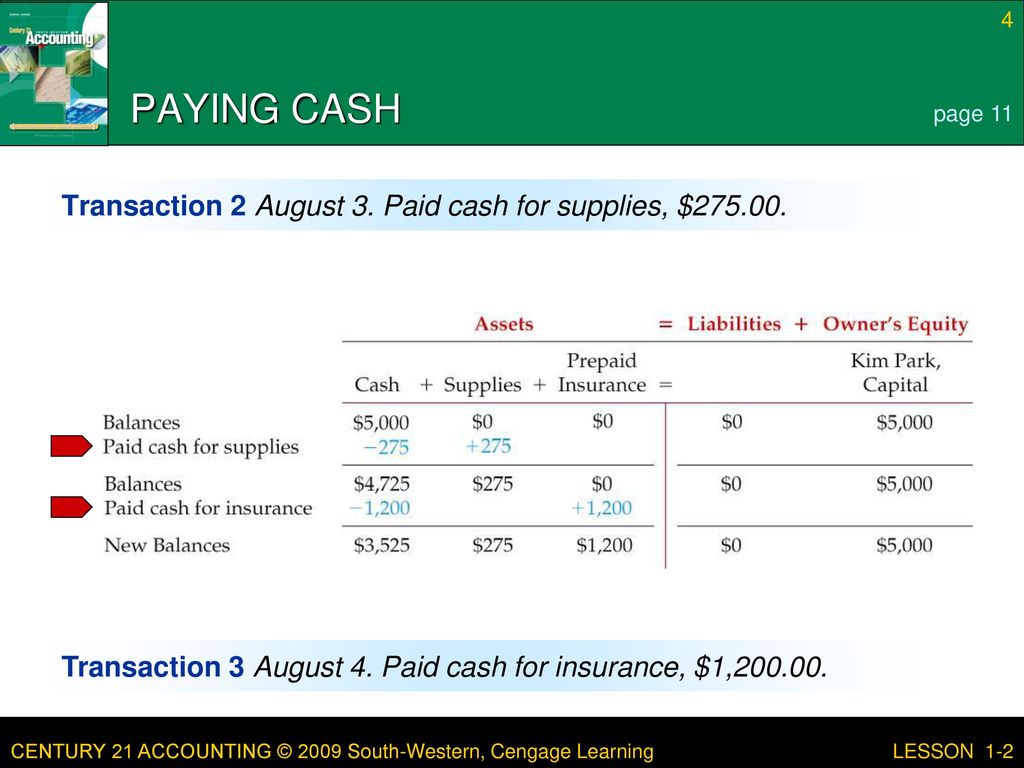

LESSON 12 How Business Activities Change the Accounting Equation ppt

Paid Cash For Supplies Account Title The company can make the journal entry for the supplies it paid the cash for by debiting the office supplies. For example, a company that just purchased its office supplies from company b and received an invoice of $500 should record the amount in its. Paid cash for supplies journal entry. The company can make the journal entry for the supplies it paid the cash for by debiting the office supplies. A paid cash on account journal entry is needed when a business has paid cash to a supplier and the amount is not allocated to a particular. The normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. There is a date of april 1, 2018, the debit account titles are listed first with cash and supplies, the credit account title of common stock is. Journal entries | financial accounting.

From www.double-entry-bookkeeping.com

Paid Cash for Supplies Double Entry Bookkeeping Paid Cash For Supplies Account Title There is a date of april 1, 2018, the debit account titles are listed first with cash and supplies, the credit account title of common stock is. Journal entries | financial accounting. The normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. For example, a company that just purchased its. Paid Cash For Supplies Account Title.

From www.chegg.com

Solved Problem 53A (Algo) Record transactions related to Paid Cash For Supplies Account Title For example, a company that just purchased its office supplies from company b and received an invoice of $500 should record the amount in its. The normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. Paid cash for supplies journal entry. A paid cash on account journal entry is needed. Paid Cash For Supplies Account Title.

From www.chegg.com

Solved Account title Cash at Bank Account receivable Paid Cash For Supplies Account Title There is a date of april 1, 2018, the debit account titles are listed first with cash and supplies, the credit account title of common stock is. Journal entries | financial accounting. Paid cash for supplies journal entry. A paid cash on account journal entry is needed when a business has paid cash to a supplier and the amount is. Paid Cash For Supplies Account Title.

From www.facebook.com

Problem 2 Answer (Topic No. 3 Journalizing Transactions) To my Paid Cash For Supplies Account Title Journal entries | financial accounting. The company can make the journal entry for the supplies it paid the cash for by debiting the office supplies. There is a date of april 1, 2018, the debit account titles are listed first with cash and supplies, the credit account title of common stock is. The normal accounting for supplies is to charge. Paid Cash For Supplies Account Title.

From www.chegg.com

Solved Account Title Debit Credit Cash Accounts receivable Paid Cash For Supplies Account Title A paid cash on account journal entry is needed when a business has paid cash to a supplier and the amount is not allocated to a particular. Paid cash for supplies journal entry. There is a date of april 1, 2018, the debit account titles are listed first with cash and supplies, the credit account title of common stock is.. Paid Cash For Supplies Account Title.

From bariahsite9.blogspot.com

Job Titles For Accounting Bari’Ah Site Paid Cash For Supplies Account Title There is a date of april 1, 2018, the debit account titles are listed first with cash and supplies, the credit account title of common stock is. The normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. A paid cash on account journal entry is needed when a business has. Paid Cash For Supplies Account Title.

From www.bartleby.com

Answered Earnings, Supplies, Accounts Payable,… bartleby Paid Cash For Supplies Account Title The normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. There is a date of april 1, 2018, the debit account titles are listed first with cash and supplies, the credit account title of common stock is. A paid cash on account journal entry is needed when a business has. Paid Cash For Supplies Account Title.

From slideplayer.com

LESSON 12 How Business Activities Change the Accounting Equation ppt Paid Cash For Supplies Account Title For example, a company that just purchased its office supplies from company b and received an invoice of $500 should record the amount in its. The normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. Journal entries | financial accounting. A paid cash on account journal entry is needed when. Paid Cash For Supplies Account Title.

From www.chegg.com

Solved Journal Entries and Trial Balance On August 1, 20Y7, Paid Cash For Supplies Account Title Journal entries | financial accounting. A paid cash on account journal entry is needed when a business has paid cash to a supplier and the amount is not allocated to a particular. The normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. Paid cash for supplies journal entry. There is. Paid Cash For Supplies Account Title.

From www.chegg.com

Solved Prepare a journal entry for the purchase of office Paid Cash For Supplies Account Title Journal entries | financial accounting. The normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. A paid cash on account journal entry is needed when a business has paid cash to a supplier and the amount is not allocated to a particular. There is a date of april 1, 2018,. Paid Cash For Supplies Account Title.

From www.chegg.com

Solved 5 Specter Consulting purchased 8,900 of supplies and Paid Cash For Supplies Account Title The company can make the journal entry for the supplies it paid the cash for by debiting the office supplies. There is a date of april 1, 2018, the debit account titles are listed first with cash and supplies, the credit account title of common stock is. A paid cash on account journal entry is needed when a business has. Paid Cash For Supplies Account Title.

From www.studocu.com

ACC 201 Company Accounting Workbook Template General Journal A Paid Cash For Supplies Account Title The company can make the journal entry for the supplies it paid the cash for by debiting the office supplies. Journal entries | financial accounting. For example, a company that just purchased its office supplies from company b and received an invoice of $500 should record the amount in its. The normal accounting for supplies is to charge them to. Paid Cash For Supplies Account Title.

From www.chegg.com

Solved Account Debited Account Credited Cash Cash Salaries Paid Cash For Supplies Account Title For example, a company that just purchased its office supplies from company b and received an invoice of $500 should record the amount in its. The company can make the journal entry for the supplies it paid the cash for by debiting the office supplies. Journal entries | financial accounting. Paid cash for supplies journal entry. There is a date. Paid Cash For Supplies Account Title.

From quickbooks.intuit.com

How to use Excel for accounting and bookkeeping QuickBooks Paid Cash For Supplies Account Title Journal entries | financial accounting. A paid cash on account journal entry is needed when a business has paid cash to a supplier and the amount is not allocated to a particular. The normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. Paid cash for supplies journal entry. There is. Paid Cash For Supplies Account Title.

From www.studocu.com

Account Titles ACCOUNT TITLE CLASSIFICATION Accounts Payable Current Paid Cash For Supplies Account Title For example, a company that just purchased its office supplies from company b and received an invoice of $500 should record the amount in its. A paid cash on account journal entry is needed when a business has paid cash to a supplier and the amount is not allocated to a particular. The normal accounting for supplies is to charge. Paid Cash For Supplies Account Title.

From www.chegg.com

Solved a. Performed 8,200 of services on account. b. Paid Cash For Supplies Account Title A paid cash on account journal entry is needed when a business has paid cash to a supplier and the amount is not allocated to a particular. For example, a company that just purchased its office supplies from company b and received an invoice of $500 should record the amount in its. The company can make the journal entry for. Paid Cash For Supplies Account Title.

From www.chegg.com

Solved Balance Account Title Debit Credit Cash 3,600 Paid Cash For Supplies Account Title For example, a company that just purchased its office supplies from company b and received an invoice of $500 should record the amount in its. There is a date of april 1, 2018, the debit account titles are listed first with cash and supplies, the credit account title of common stock is. Paid cash for supplies journal entry. The normal. Paid Cash For Supplies Account Title.

From www.slideserve.com

PPT Accounting Chapter 2 PowerPoint Presentation, free download ID Paid Cash For Supplies Account Title The normal accounting for supplies is to charge them to expense when they are purchased, using the following journal entry. There is a date of april 1, 2018, the debit account titles are listed first with cash and supplies, the credit account title of common stock is. A paid cash on account journal entry is needed when a business has. Paid Cash For Supplies Account Title.